All Been Crypto — Week 9 Sep 2022

What a week — we are a few days away from the all important Ethereum merge but it seems like Luna is stealing the show at least for today. After a crazy rally in Luna Classic (due to a new tax burn mechanism) now the new Terra token is up 2x within the past 24h. Certainly sparked the animal spirits again pushing our market cap back to 1.1tn. No wonder BTC dominance continues to creep lower now down to 36%. In the news we had Binance consolidating stable coins around BUSD, Gary Gensler conceding somewhat to the CFTC, Coinbase announcing to back the Tornado Cash lawsuit against Treasury and Mysten Labs (the creators of alt L1 Sui) raising 300m at 2bn valuation lead by FTX Ventures. Who said crypto markets were starting to get boring and only macro driven. Enjoy reading!

Bat Tai Chi — btc21@mail.com

HEADLINES:

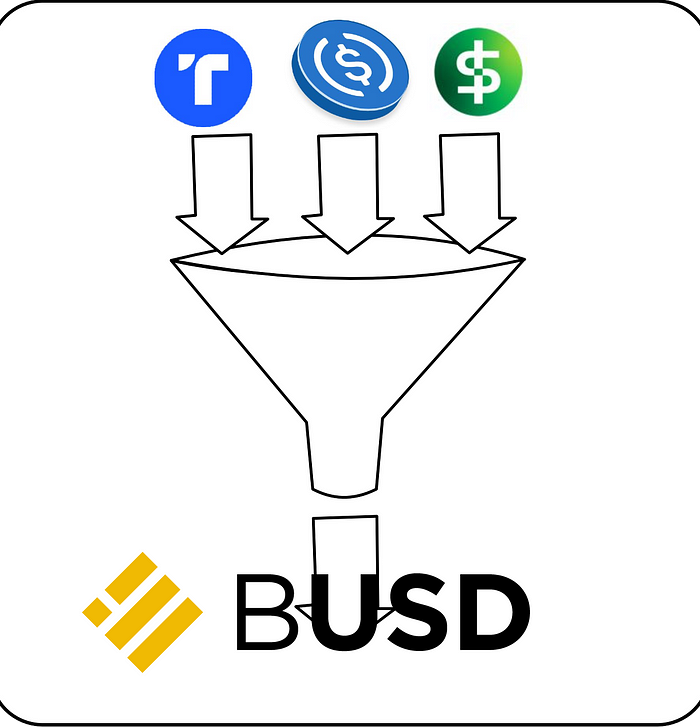

Binance consolidates stable coins into BUSD

Binance this week announced in a surprise move that it would auto convert USD Coin (USDC), Pax Dollar (USDP), and TrueUSD (TUSD) into BUSD upon transfer to the exchange. The reason was given as to facilitate liquidity in trading pairs on the exchange which will now only be offered vs BUSD and USDT. Many headlines focused on the de-facto elimination of all USDC trading paris and got it wrong in the sense that this isn’t necessarily a -ve for USDC per se. There were calls of this being a power grab and some are worried rendering Binance the choice to exclude stable coins at the later stage from the equivalence but obviously it will depend on what the future steps would be for now users are still able to withdraw/deposit in all three assets so it just really serves the purpose of concentrating liquidity. Even Circile’s Jeremy Allair sounded supportive of the move and predicts USDT being the major loser given how BUSD and USDC now being equivalent. I tend to agree that for now regulatory backlash risk seems limited and the move is a +ve for BUSD upgrading liquidity while probably more or less neutral on the other stable coins. USDT has been losing ground over the past two years but recently saw a slight reversion of that trend after some got spooked with the Tornado Cash events and USDC freezing. As we head more and more towards mainstream adoption and regulatory compliance it is natural that these stable coins grow faster but there will always be demand for both and some level of competition in the space is also healthy.

ETH merge countdown

Next week we will have the major event behind us (most likely) the countdown is ticking estimated for the 13/14th September. Bellatrix went live however it seems that this time not without some minor hick ups, from what I’ve heard some major validators missed the upgrade which might have been the reason for the much larger than usual missed block rate. A bit surprising given how well the merge is publicized and anticipated. It feeds into the main thematic though that the potential failures appear to be less on the technical side and more on the human error and game theory side of things. Missing blocks and down time can lead to adverse effects for the particular validators but if small does not impact overall ETH network security — it only becomes an issue if a large number of validators go offline at the same time. As such it should not deter the upcoming merge and so one other potential area of focus is what could happen with a speculated hard fork for ETH proof of work. The chances of this happening seem high with exchange and now even ETP issuers announcing listing. Shadow price however seems to have dropped further to ~25 now and many expect that liquidity in the new token would dry up quite quickly with the pad likely being very one sided skewed towards sellers. And then of course you have to stay alert on scammers that will be lurking with all the uncertainty and edge cases around the merge. So many headlines confusing retail about an airdrop (which is just the fork basically) and so it is understandable that people get confused.

Gensler backs CFTC having oversight of BTC

Gary Gensler made the comments while speaking at an industry conference Thursday. Gensler mentioned that he is in support of the recent bill from Congress. This is an interesting time to make such statements as clearly BTC has been named as a commodity by him and ETH transitioning away from PoW. I could see a way how there will be a trail of arguments for PoS changing ETH and not defining it as a commodity thereby a security and bringing it under SEC rule. And while BTC will now bear the burden of the enter energy and ESG debate as the only major crypto remaining on PoW ETH could now become the beacon of SECs attention and so more bifurcation in crypto seems inevitable. But of course it could just be entirely coincidental and more to do with the recently introduced bill in congress that would give primary authority over cryptocurrencies to the CFTC.

QUOTES:

Very big week in DC for Circle. Crypto and digital currency policy is in full game-on mode. Let’s see what his country can do!

Jeremy Allaire, Circle CEO

To the extent the Commodity Futures Trading Commission (CFTC) needs greater authorities with which to oversee and regulate crypto non-security tokens and related intermediaries, I look forward to working with Congress to achieve that goal consistent with maintaining the regulation of crypto security tokens and related intermediaries at the SEC

Gary Gensler, SEC Chair

Coinbase is funding a lawsuit brought by six individuals challenging the Treasury’s sanction of the Tornado Cash smart contracts

Brina Armstrong, Coinbase CEO

New to trading? Try crypto trading bots or copy trading